- Home

- Logifleet Blog

- Fleet Management Trends 2026: What Swiss Construction Companies Need to Know

Fleet Management Trends 2026: What Swiss Construction Companies Need to Know

.png?width=776&name=Black%20Orange%20Modern%20Construction%20Presentation%20(52).png)

“Where is the machine now?”

“The tool is at the wrong construction site again.”

If you manage construction operations in Switzerland, you’ve probably heard these lines more times than you’d like to admit.

And the real problem isn’t that equipment goes missing.

It’s that your construction fleet (vehicles, machines, tools, and assets) is spread across multiple cantons, timelines are tighter, and every hour of downtime costs real money.

When tracking breaks down, even in small ways, the impact adds up fast. Idle crews, delayed work, last-minute rentals, duplicate purchases, and nonstop phone calls just to figure out what’s happening where.

That’s why fleet management in 2026 is shifting away from vehicle-only tracking and toward full jobsite visibility.

In this blog post, we’ll break down the biggest construction fleet management trends for 2026 and what they mean for Swiss construction companies that want tighter control over utilization, productivity, and margins.

TL;DR: Fleet Management Trends 2026 (Switzerland)

- By 2026, construction fleet management in Switzerland will shift from manual oversight to jobsite-level, data-driven control.

- Electrification, AI, telematics, and assisted autonomy will increase complexity across mixed fleets.

- Manual tools like spreadsheets won’t scale under tighter timelines, sustainability goals, and regulations such as LSVA III and FADP (Federal Act on Data Protection).

- Construction companies will prioritize one platform that connects vehicles, machines, tools, and workforce activity.

- Solutions like Logifleet 360°, combining Vehicle Connect, Machine Connect, Tool Connect, and Worker Connect, reflect where fleet management is heading: fewer isolated systems, clearer visibility, and calmer project execution.

Trend 1: Fleet Electrification in Switzerland Will Accelerate for Construction Fleets in 2026

While electromobility is already well established in road transport, it remains at an early stage on construction sites.

However, the pressure to change is growing fast, driven by the scale of construction-related emissions.

That level of impact is putting growing pressure on the construction industry.

Climate targets, stricter air-pollution regulations, and sustainability strategies are no longer abstract goals.

In Switzerland and across Europe, CO₂ reduction targets, low-emission zone rules, and city-led clean construction requirements are directly pushing construction companies to electrify vehicles, machinery, and site logistics.

For construction fleets, this shift introduces new complexity. Electrification isn’t just about swapping vehicles. It affects:

- How equipment is allocated across sites

- How long assets remain in use

- Where charging infrastructure is viable

- Whether utilization justifies the investment

That’s why electrification decisions in 2026 will increasingly depend on equipment utilization tracking in Switzerland, rather than assumptions or averages.

Construction companies will need a clear view of how vehicles and machines are actually used across sites before committing to electrified fleets at scale.

In short, electrification is coming to construction sites. The companies that prepare early, using real usage data, will be better positioned to adapt without disrupting productivity or margins.

Trend 2: AI Will Shift Construction Fleet Management From Tracking to Predictive Decisions

Managing construction fleets has always been complex, but the challenge intensifies as fleets grow and job sites multiply.

Coordinating vehicles, machines, tools, and workforce movement across multiple locations leaves little room for error.

In 2026, AI in construction fleet management software will move from reporting to day-to-day operational decision-making.

Instead of simply showing where assets are, AI will increasingly guide how fleets are used across construction sites.

Key AI-driven changes construction fleets will see:

- Real-time route optimization: AI systems will continuously analyze live GPS data, traffic conditions, weather, and site access constraints to adjust routes on the fly. This helps vehicles avoid delays, reach project locations faster, reduce fuel consumption, and limit unnecessary emissions.

- Predictive maintenance to reduce downtime: Rather than relying on fixed service intervals, AI analyzes sensor data like vibration patterns from moving parts, temperature changes, and real-world usage to spot early signs of wear before failures occur. Early warnings allow maintenance to be scheduled before breakdowns occur, improving equipment availability and extending asset lifespan.

- Driver behavior monitoring for safer operations: AI-based analysis will flag risky driving patterns such as harsh braking, speeding between sites, or inefficient acceleration. These insights support targeted coaching, improved safety, and lower wear on vehicles.

- AI-enhanced telematics for better decisions: Telematics data becomes more valuable when AI identifies patterns across routes, driving behavior, and site conditions. Construction teams can use these insights to optimize planning, reduce idle time, and improve overall fleet efficiency.

- Fuel efficiency and sustainability improvements: By analyzing route choices, vehicle load, driving style, and environmental conditions, AI can highlight where fuel savings are possible. These optimizations help fleets cut costs while supporting emissions reduction targets.

What this means in practice:

By 2026, AI in construction fleet management will help teams decide what to do next, not just explain what already happened. Predictive insights will guide maintenance, routing, safety, and utilization decisions across construction sites in real time.

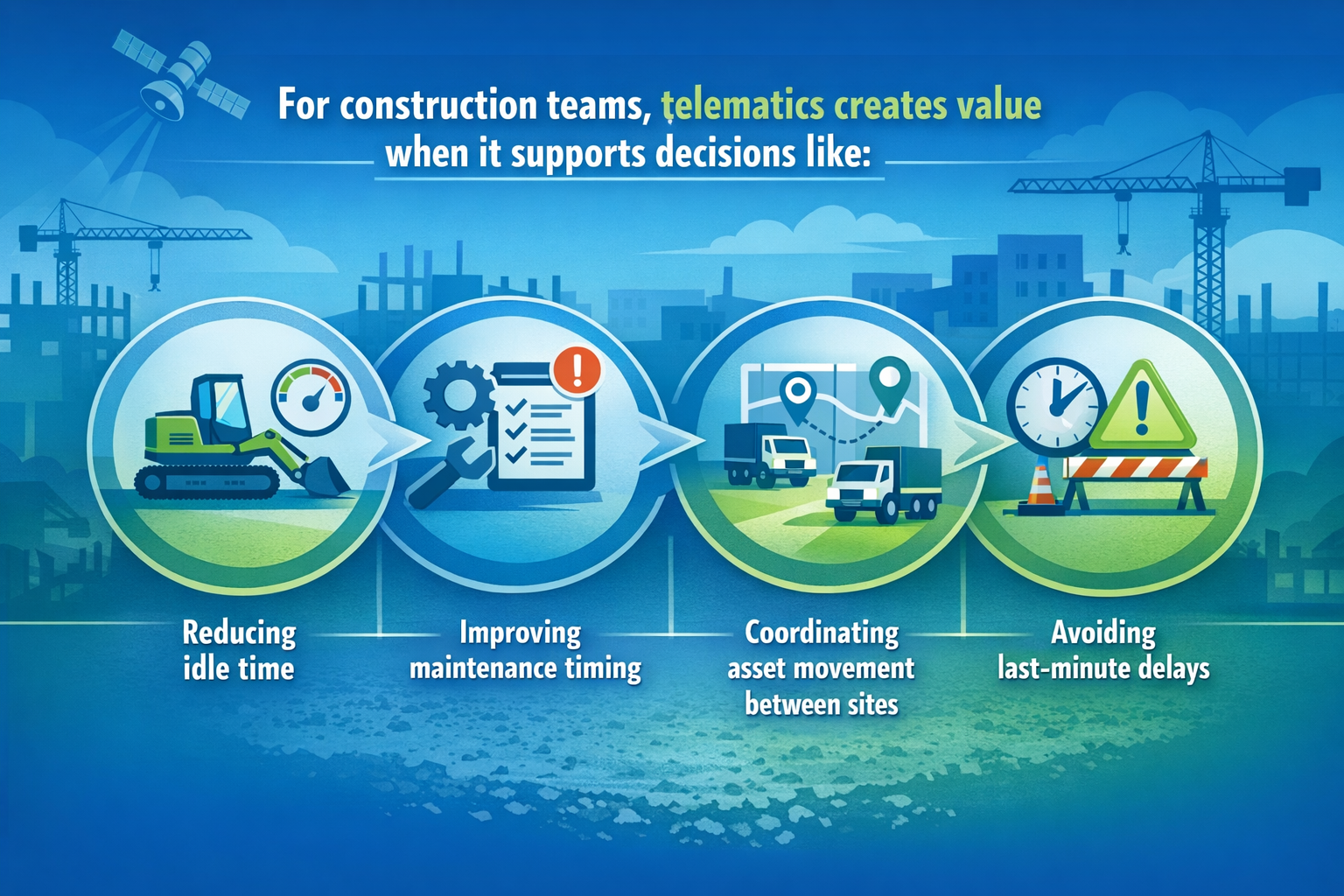

Trend 3: Telematics and Fleet Tracking Software in Switzerland Will Become a Daily Efficiency Standard

Telematics and fleet tracking software in Switzerland will stop being “reporting tools” and become part of daily operations in 2026.

Vehicle-only insights won’t be enough. Telematics will increasingly need to support mixed fleets, where tools, machines, and vehicles are all part of the same operational picture.

As a result, teams are moving away from generic fleet tools toward solutions designed for real on-site operations.

Trend 4: Driver Safety Monitoring Will Become a Core Feature in Fleet Management Trends 2026

Driver safety monitoring will become a baseline expectation within fleet management trends 2026, particularly for construction companies operating across multiple sites.

Safety risks don’t only appear on the road; they show up during rushed transfers, tight schedules, and poorly coordinated movements between project sites.

In 2026, safety tools will become more proactive, helping teams:

- Identify risky patterns early

- Improve accountability

- Reduce incidents tied to time pressure

For Swiss construction companies, safety isn’t just compliance. It’s closely tied to reliability, reputation, and client trust.

Trend 5: Autonomous Vehicles Will Enter Fleet Technology Trends 2026 Through Assisted Features First

By 2026, autonomous vehicles will become part of fleet technology trends, but through assisted capabilities rather than fully driverless construction sites.

What this will look like in practice:

- Assisted driving and safety features are becoming standard in fleet vehicles

- Automation in controlled environments such as yards, depots, and industrial zones

- Fixed-route automation between predictable locations rather than dynamic jobsites

That said, fully autonomous sites remain unlikely in the near term. Construction companies that build strong tracking, telematics, and data foundations now will be best positioned to benefit as autonomous capabilities mature.

Trend 6: Jobsite Asset Tracking Will Replace Manual Oversight in Swiss Construction Fleets

In 2026, the Swiss construction industry is undergoing a pivotal shift as automated site-level asset tracking definitively replaces manual oversight.

This trend is driven by the need for real-time visibility across complex mixed fleets and increasingly compressed project timelines.

Regulatory pressure in Switzerland is also increasing. Requirements such as LSVA III, the country’s revised heavy vehicle charge framework, make accurate, data-backed records of vehicle usage and movement across sites essential. Manual estimates won’t be enough.

This is why site-level asset tracking in Switzerland is becoming one of the most practical upgrades construction companies can make. As a result, teams can:

- Coordinate mixed fleets more effectively

- Reduce unnecessary transfers and rentals

- Support reporting and compliance with less admin effort

- Make faster, more confident operational decisions

In short:

Construction asset tracking in Switzerland is becoming essential because manual oversight cannot keep up with mixed fleets, tighter schedules, and stricter reporting requirements.

Trend 7: Sustainability in Construction Fleet Management Will Be Measured Through Equipment Utilization Tracking

In 2026, sustainability in construction fleet management will shift from stated goals to measurable operational outcomes.

For construction companies, the biggest sustainability gains won’t come from headline commitments alone.

They’ll come from reducing waste inside day-to-day operations, unnecessary movements between sites, idle machines, underused tools, and avoidable fuel consumption.

As emissions regulations tighten and project owners place more emphasis on sustainable delivery, construction teams will be expected to show how efficiently assets are actually being used, not just what policies are in place.

In practice, better visibility leads to leaner operations. When teams know what is available, where it is, and whether it’s being used, they can reduce waste without slowing projects down.

This year, sustainable construction fleets won’t just be greener on paper. They’ll be more efficient, more predictable, and better controlled, with sustainability driven by smarter utilization rather than additional complexity.

Trend 8: Cybersecurity and Data Protection Will Become Non-Negotiable for Asset Tracking Software in Switzerland

This year, cybersecurity and data protection will no longer be secondary considerations in construction fleet management. They will be core requirements.

As fleets become more connected, tracking systems increasingly handle sensitive operational data: construction site locations, vehicle movements, asset usage, workforce activity, and project timelines. This data is now business-critical.

In Switzerland, regulations such as the Federal Act on Data Protection (FADP) reinforce this shift.

As expectations around data handling, access control, and system security rise, construction companies will need greater confidence in how fleet and jobsite data is stored, shared, and protected.

What will change in practice:

- Fleet platforms will be evaluated not just on features, but on security and reliability

- Clear access controls and permissions will become standard expectations

- Secure integrations will matter as much as standalone functionality

- Downtime and data gaps will be treated as operational risks, not just IT issues

This means that in 2026, protecting fleet data will be inseparable from protecting operations. Secure systems won’t be a differentiator; they’ll be the baseline.

Construction Fleet Management in Switzerland: The 2026 Shift That Actually Matters

This year, the biggest shift won’t be about a single technology. It will be about bringing everything together at the worksite.

Construction companies are no longer managing vehicles in isolation. They’re coordinating tools, machines, equipment, and workforce activity across multiple sites, often in parallel. When that coordination fails, margins suffer immediately.

That’s why Swiss construction teams are moving toward a single operational view that reflects project site reality, not fragmented systems.

The ability to answer one question consistently will separate leaders from laggards:

Is everything we need on the right jobsite, right now?

Final Thoughts: 2026 Will Favour Construction Teams That Simplify Control

The construction fleet management trends shaping 2026 all point in the same direction: fewer manual handoffs, less guesswork, and clearer site-level control.

As projects grow more complex, teams that rely on disconnected tools for vehicles, machines, tools, and workforce data will feel the strain. Visibility gaps don’t scale, especially when assets and people are constantly moving between sites.

Construction companies that simplify how they manage mixed fleets will be better positioned to:

- reduce idle time across vehicles, machines, and tools

- improve utilization by knowing what is available and where

- coordinate project sites with greater confidence

- protect margins without adding administrative overhead

This is exactly the direction solutions like Logifleet are designed for.

By combining Vehicle Connect, Machine Connect, Tool Connect, and Worker Connect into a single platform, Logifleet gives construction teams one site-focused view of everything that matters.

Instead of managing assets in silos, teams can make use of Logifleet 360° to see whether the right mix of vehicles, machines, tools, and workers is actually in place and working productively.

In the end, 2026 won’t reward construction teams that track everything in isolation. It will reward those who bring everything together and turn visibility into control.

When that happens, teams can look at their operations with confidence and say, “So, now we have clarity!“

Frequently Asked Questions (FAQs)

What are the main construction fleet management trends for 2026?

The main construction fleet management trends for 2026 include fleet electrification, AI-driven decision-making, advanced telematics, jobsite asset tracking, sustainability through better utilization, assisted-autonomous vehicle features, and stronger cybersecurity. Together, these trends are pushing construction companies toward centralized, construction site-level fleet visibility instead of manual oversight.

Why is jobsite asset tracking important for construction fleets in Switzerland?

Jobsite asset tracking is important in Switzerland because construction fleets operate across multiple sites with frequent movement of vehicles, machines, tools, and workers. Manual tracking cannot keep pace. Regulatory requirements such as LSVA III also increase the need for accurate data on vehicle usage and movement across jobsites.

How does AI improve construction fleet management?

AI improves construction fleet management by enabling predictive decisions rather than reactive tracking. It supports route optimization, predictive maintenance, driver behavior analysis, and deeper insights from telematics data. This helps construction fleets reduce downtime, fuel consumption, and inefficiencies while improving safety and utilization.

Will autonomous vehicles replace drivers in construction fleets by 2026?

No, autonomous vehicles will not replace drivers in construction fleets by 2026. Adoption will focus on assisted and semi-autonomous features in controlled environments such as yards, depots, and fixed routes. Fully autonomous construction sites remain unlikely due to safety, regulatory, and infrastructure constraints.

How does sustainability affect construction fleet management in 2026?

In 2026, sustainability affects construction fleet management by shifting focus from intentions to measurable outcomes. Construction companies reduce emissions by improving asset utilization, cutting idle time, minimizing unnecessary transfers between jobsites, and avoiding duplicate rentals through better operational visibility.

Why is cybersecurity critical for construction fleet management systems?

Cybersecurity is critical because fleet management systems store sensitive operational data such as construction site locations, asset movement, and workforce activity. In Switzerland, regulations like the Federal Act on Data Protection (FADP) increase expectations around secure data handling, access control, and system reliability.

What is Logifleet 360°?

Logifleet 360° is an integrated construction fleet management approach that provides a single jobsite-focused view across vehicles, machines, tools, and workforce activity. It combines vehicle, machine, tool, and worker tracking to help construction teams improve utilization, coordination, and operational control.

En Budron H9

CH-1052 Le Mont s / Lausanne

T +41 21 651 06 51

Merkurstrasse 25

CH-8400 Winterthur

T +41 71 277 52 47